AQN examined the Small Business space at the start of the COVID Pandemic, focusing on what comes next for lenders in the space. Since then, the pandemic forced further change in the industry. Another round of PPP loans started recently, major SME lenders were acquired, widespread in-person relationship management stopped, and demand for loans shifted. Here we share some of AQN’s thoughts on the last year of change, how things may look after, and what’s on our minds as we start 2021.

Read MoreMany clients have recently asked AQN how they can start or grow their consumer lending businesses to deploy low-cost deposits. COVID response and government stimulus led to reduced lending and reduced customer spending, resulting in shrinking loan portfolios and growing deposit bases. More banks and credit unions face a deposit to loans mismatch that leads to net interest margin compression; they are exploring ways to quickly deploy capital into new loans.

Read MoreWe recently surveyed our network of consumer lending executives to see how they expected non-residential lending risk to evolve over the next 12 months. While few anticipate risk will remain artificially low in the long term, most expect the depth of economic recession forecasted back in March may not fully materialize.

Read MorePOS lending has been a recurring hot topic for several years now and is heating up again as lenders and merchants prepare to reorient their businesses in light of the economic impacts of COVID-19.

Read MoreBanks are likely on the precipice of seeing a two-fold impact in their current credit risk reporting. First, consumers have started aging out of the first round of hardship programs and second, CARES benefits have expired, including enhanced unemployment.

Read MoreUncertainty is the term AQN has heard the most when talking to bank leaders and lenders during the pandemic. The world has changed a lot for everyone, and commonly held pre-crisis truths in lending may not stand in the coming months and years. To date, defensive moves have been the market move. Provide relief for customers; cut back on marketing and acquisitions; lower current unused exposure. While effective in the short run, these are not sustainable strategies.

Read MoreOne of the most intriguing questions about the efficacy of the program is what proportion of the job market was subsidized by the PPP. The US lost more than 20 MM jobs in April after unprecedented government stimulus. How many jobs would have been lost without that stimulus? It’s a frightening question, and one that can’t be perfectly answered. Not all jobs that were reported as ‘retained’ under PPP would have been lost without the program. And not all jobs that were saved by government action were saved by the PPP. Still, comparing the number of jobs retained to the overall size of the labor market illustrates how important the program was for stemming the unemployment crisis.

Read MoreBank branch closing seems inevitable. But is it? From cost to community, Angie Tuglus and Thomas King discuss why this happens, the unintended consequences, and if there is a better way forward.

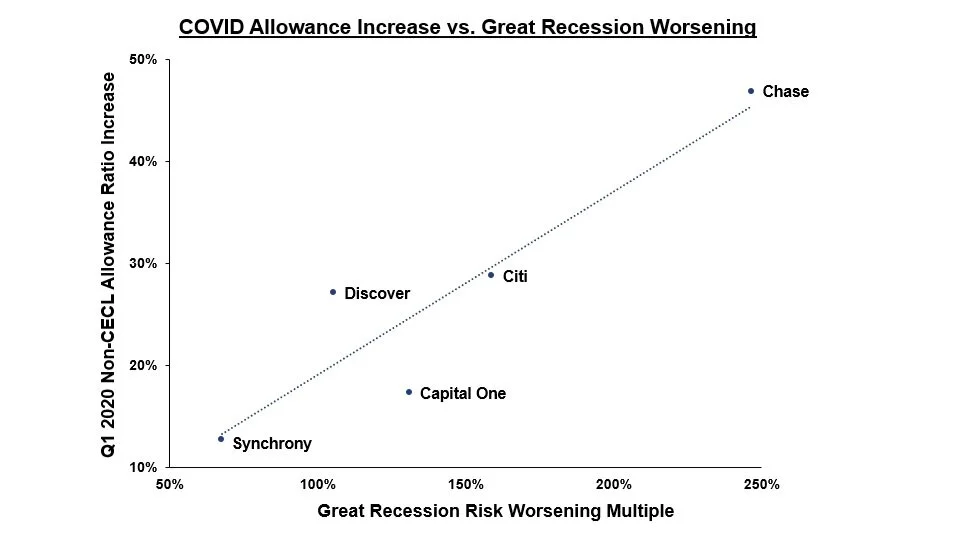

Read MoreJournalists, industry research groups, government agencies, and others have spent several months pontificating about what the economic fallout from the COVID-crisis might look like in the lending industry. With the release of 1Q2020 earnings and regulatory reporting, we got our first look at actual impacts – sort of.

Read MoreAs a consulting firm specializing in consumer and small business lending, we’ve had ongoing crisis-related discussions with dozens of clients and experts across the industry. The question at the center of these conversations is always “How badly will this impact lending?” Both sides of the debate are offered up without meaningful stances taken, as if lenders are balancing weights on both sides of a scale. A single party can find themselves arguing both positions, ultimately ending up back at square one with a “wait and see” approach. What I can offer is a list of no-regrets actions you can take today to be ready for the future.

Read MoreIf you are a lender who entered the crisis with an active loan portfolio, you have without a doubt been thinking about managing credit stress in your portfolio. Providing payment relief to distressed borrowers was likely an integral part of your reaction, and it has several considerations like I discussed in an earlier blog post. Recent data from Transunion now shows an enormous spike in the percentage of accounts in hardship across loan categories. It is noteworthy that some banks have deferred payments for more than 15% of their loan portfolios, according to Janney Montgomery Scott in this Bloomberg article. Trends in serious delinquency rates are however nowhere close to such extremes, masking the true nature of risk here.

Read MoreFor the last two months, consumers and businesses alike have grappled with the challenging realities of a world operating under the COVID crisis. While Americans have largely been inundated with bad news, one of the few bright spots has been the government’s relatively quick and substantive effort to provide the financial support necessary to keep the economy intact. Legislation to supply small businesses with government loans was swiftly enacted through the Paycheck Protection Program, providing over $500 billion in support to more than 4.3 million businesses. While these efforts have been broadly applauded, the policy prioritized speed to implementation over thoroughness, resulting in gaps that are causing pain for both small business recipients and the bank facilitators of these loans.

Read MoreThe credit loss bubble will not be the only impact of COVID-19 on credit card issuers, changes in consumer spend behavior are also suppressing interchange revenue. This is especially true for high-end transactor products, despite being poorly understood by the very banks experiencing this decline.

Read MoreIf you build or rely on statistical models to drive decisions for your lending business, you should be worried. The models used by lenders since the Great Recession were built using increasingly sophisticated data sources during one of the most prosperous times in modern history. As banks protect assets and help consumers, in part by offering forbearance programs for some COVID-19 impacted borrowers, data quality will deteriorate. Given the skew forbearance programs cause in reported bureau delinquencies, the credit data that is available can hardly be trusted.

Read MoreThe growth curves for unemployment rates of COVID-19 look an awful lot like those of large natural disasters. After the first three weeks of surges, the NY Fed equated the impact to hurricanes Katrina and Maria. Looking at the data, we agree it is hard to deny the similarities which have only gotten stronger as more claims data became available. AQN also looked into some of the key outcome metrics for consumer financial products after hurricane Katrina to try and baseline how lenders should be thinking about impacts to their portfolios.

Read MoreThe rubber band has been pulled too far, so when you finally let go, it won’t return to it’s original shape. The popcorn can’t be unpopped. You can’t put the toothpaste back in the tube. Choose your favorite metaphor, but whichever one it is, the answer is the same: The world is not going back to the way it was before COVID.

Read MoreThe world is in the midst of a global crisis. So far, the COVID public health and employment crisis has not turned into a widespread banking crisis. Why is this? One reason is that banks are, in general, far better capitalized than they were in the last crisis. While banks return on assets recovered to pre-financial crisis levels, return on equity never fully recovered due to increased capital requirements. What was long seen as a downside in bank performance may finally be seen by investors and us all as a virtue. Want to know more? We go through all the math below.

Read More

Crises and recessions tend to punctuate and accelerate trends that were previously slow and sometimes unnoticed. Unemployment numbers are up by at least 22 million in the last month, consumer spending was off over 8% in March, and trillions of stimulus dollars are now flying (or failing to fly) around the country. This crisis is going to change things farther and faster than prior ones did. Today, let’s talk about the impact to digital adoption in banking.

Read MoreAQN Payments Monthly is a regular review of news in the payments space, along with AQN’s perspective on how that news impacts you and your business.

Read More