The last few weeks have led to a lot of thinking about what comes next – for our families, our friends, for our local communities, and for our country.

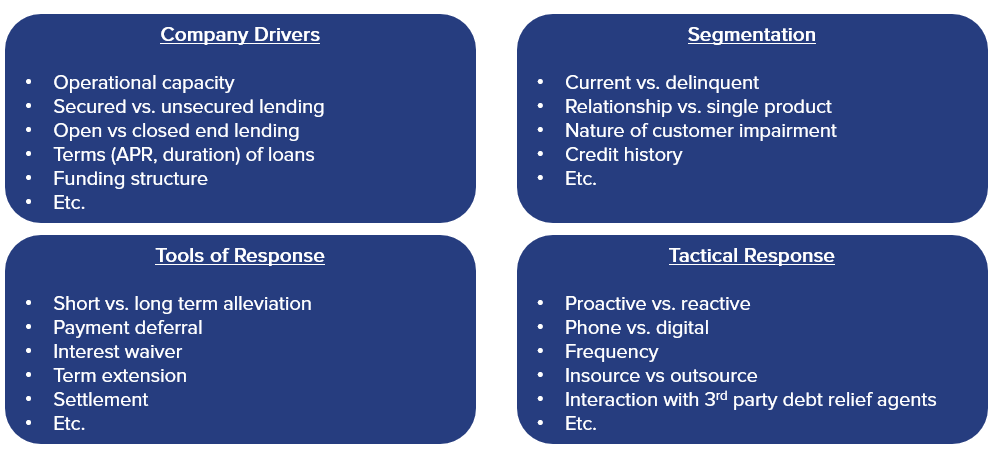

Read MoreThis week, the questions we hear most are about Customer Assistance Programs. Lenders of all stripes are looking for ways to better work with customers and to accommodate their rapidly changing and diverse needs in this crisis.

Read MoreAs part of the BRD Insights blog series, today we look into the asset mix at banks of different sizes. Asset mix is a telling indication of the strategic focus of banks and is the primary driver of banking economics.

Read MoreDepending on how you count it, this is either my third or fourth recession leading or advising lending businesses. Note that I say “is.” We are in a recession right now and there is no doubt about it.

Read MoreThe extraordinary events over the last few weeks related to the unfolding pandemic and the responses to it are having profound effects across all aspects of people’s lives and the economy. Consumer and Small Business lenders face challenges in how to balance their customers’ needs and hardships with the safety and soundness of their institutions.

Read MoreThese are unprecedented and challenging times. There are a lot of disruptions to the routines of daily live with the arrival of COVID-19. One that changes the daily lives of many Americans will be the closing of offices and the expectation that people work from home; indefinitely.

Read MoreAQN Payments Monthly is a regular review of news in the payments space, along with AQN’s perspective on how that news impacts you and your business.

Read MoreThe trade-related stresses already present in international markets compounded by the virus-driven threat to supply chains and risk of large-scale quarantines, have put the US economy at risk of falling into recession.

Read MoreThis delicate balance frequently led strategic discussions back to a single core debate: should we acquire, or should we look to be acquired?

Read MoreDeposits are a critical component of the traditional banking equation. Banks with a sizeable deposit base can extend lower margin loans or can increase returns on existing loans. A regular review of public deposit data is an important part

Read MorePolling the AQN office reveals a strong consensus of our ideal midsize bank or large Credit Union: high margins driven by low cost deposits and high yielding assets.

Read MoreAQN Strategies is excited to announce our relationship with BankRegData.com (“BRD”), a website that has cleaned and provided call reports data to its users for nearly 10 years

Read MoreWe’re excited to announce that Jeff Tennenbaum is joining the leadership team at AQN Strategies as a Managing Director and Head of Business Development. Jeff will be responsible for driving growth in each of AQN’s lines of business, as well as establishing AQN’s brand as the “go-to” for strategic thinking and development of analytical capabilities required to compete in the financial services industry today.

Read MoreIn the world of digital marketing for consumer lending, third party affiliate sites offer several advantages to both consumers and financial services providers. Building an internal valuation estimate for accounts booked through these sites is a first step for determining which leads will be profitable to begin with.

Read MoreCome see Ben take part in the Great Debate - Banks vs. Fintechs and the future of banking in the Americas

Read MoreTen years removed from the Great Recession, shifting market dynamics have taken us from “too big to fail” to “too small to succeed.” This different frame of reference allows us consider the future of small and mid-sized banks in the US - and discuss what these banks can do to compete and win in this ever-changing competitive environment.

Read MoreAQN’s anniversary comes at a time of exceptional growth and excitement at the firm.

Read More